how to become a tax accountant in canada

YOu will need a bachelors degree to become an accountant in Canada. Get an Entry-Level Position as a Tax Accountant.

How To Become An Accountant Salary And Career Outlook

Choose Your Career Path.

. You can choose to specialize in a specific field of. While a high school diploma or GED is the minimum requirement to become a tax preparer consider a college diploma or undergraduate degree. Continued Education for Your Tax.

The most successful personal tax consultants are those who keep learning about different aspects of taxation. Obtain an undergraduate degree from any recognized university in Canada. Studying in an recognised university is necessary to become a Chartered Accountant.

Filing tax documents on a clients behalf. However this may not be. Business Administration with a focus in.

Upon successful completion of the CPA Professional Education program you will. Preparing federal and state tax returns. Take the Certification examination.

The team at QuickBooks Canada is here to give. Having a degree in accounting is not required to. Complete and submit your application to become an authorized IRS e-file provider.

As a tax preparer you will be dealing with a long list of taxes which you have to deal with to maximize deductions. As a tax professional your regular tasks and responsibilities might include. If you already have an undergraduate degree with an accounting focus then follow this default route to become a CPA in Canada.

Offering tax planning advice. Here are the steps to follow for how to become a tax accountant. Determining your career path is often the next step to becoming an accountant.

Get an Entry-Level Position as a Tax. How to Become a Chartered Accountant. Choose a Specialty in Your Field.

Consulting with clients to help them prepare for tax season over the year. Canadas accounting programs support the concept that accountants should learn how their work affects business decisions rather than strictly being taught accounting. CPA Canadas Financial Literacy Program examines global financial subjects trends and issues in this unique.

Advance in Your Tax Accountant Career. If qualified you will be admitted to the CPA PEP. By QuickBooks Canada Team.

It can take up to 45 days for the IRS to approve an e. January 9 2017 3 min read. The Canadian Institute of.

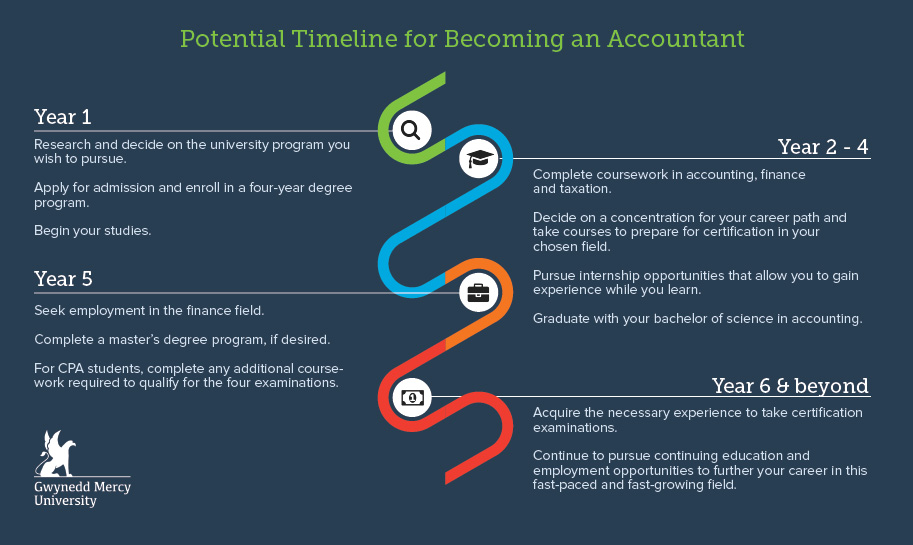

Below are the steps generally required to begin and advance your Tax Accountant career. Begin the process of becoming a tax accountant by pursuing a bachelors degree. To become a tax accountant individuals need to develop professional skills study for relevant qualifications and gain invaluable work experience within the industry.

Money and the World Virtual Conference 2022. The following steps outline how to develop a career as a Chartered Professional Accountant a credential that has nationwide recognition. The responsibilities of a tax accountant include.

To become a tax accountant you typically need at least an undergraduate degree in one of the following fields. Choose a Specialty in Your Field. Chartered accounting professionals get their certification by taking the uniform final evaluation known as UFE.

Create an IRS e-Services account on the IRS website. Therefore the ability to.

How To Become A Chartered Professional Accountant Cpa In Canada

How To Become An Accountant In Canada Cpa Qualified Unravel With Tolu

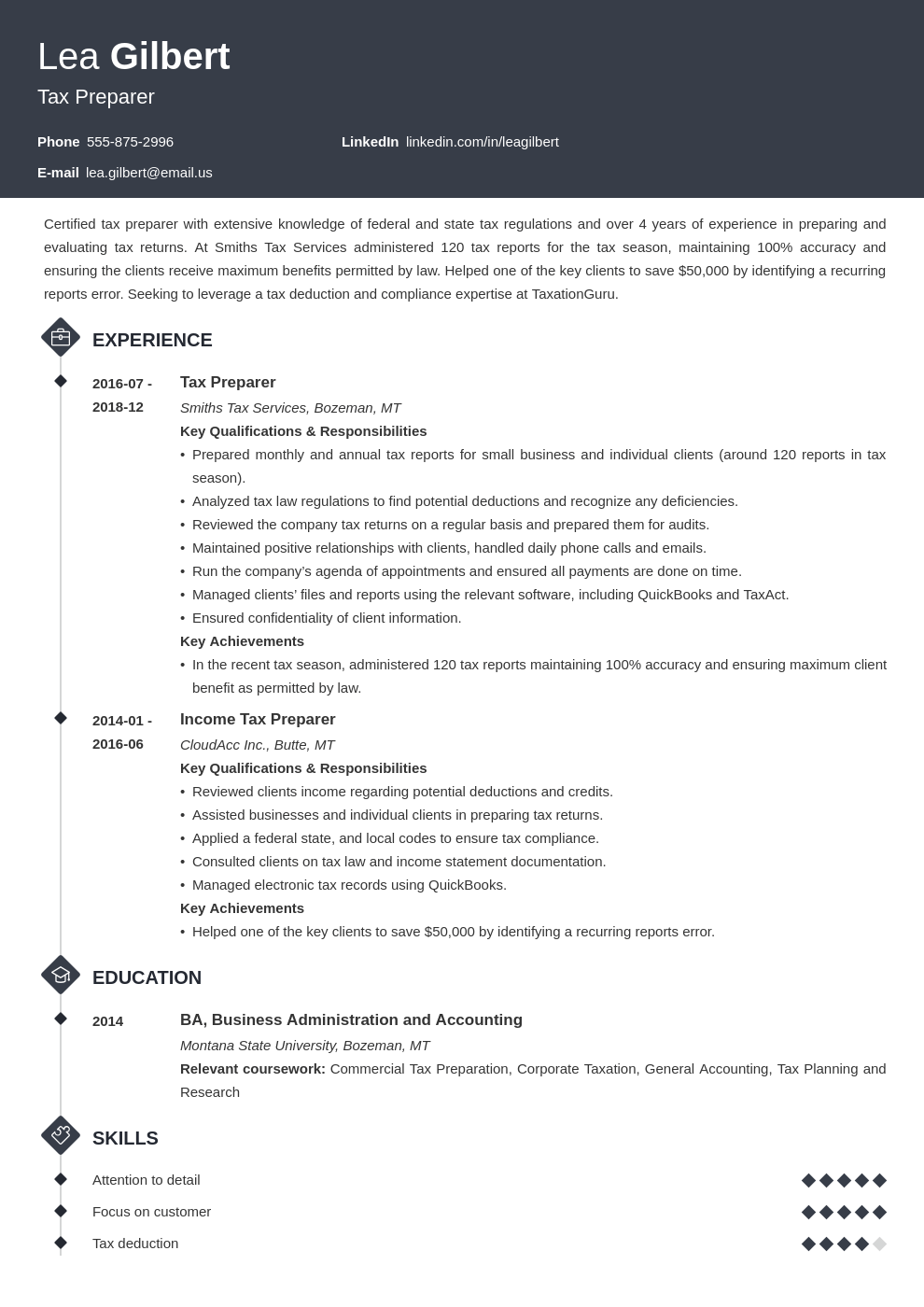

Tax Preparer Resume Sample Writing Guide 20 Tips

Non Resident Tax Services For Canada Tax Doctors Canada

Homepage Top Chartered Professional Accountant In Mississauga Triple J Canada

The Accounting And Tax Tax Preparation Expert Canada And U S A

Becoming A Tax Preparer In Canada In 5 Steps Work Study Visa

Master Of Tax Accounting Huizenga College Of Business

How To Find The Best C P A Or Tax Accountant Near You The New York Times

How To Become An Accountant Learn The Steps Degrees Requirements

:max_bytes(150000):strip_icc()/young-female-artist-in-studio-working-on-laptop-539434611-5a4e8a5b842b170037c8b2ca.jpg)

How To Prepare Taxes For Your Accountant

Tax Preparer Education Requirements Accounting Com

The Accounting And Tax Tax Preparation Expert Canada And U S A

Tax Manager Average Salary In Canada 2022 The Complete Guide

Senior Tax Accountant Resume Samples Qwikresume

How To Become A Tax Preparer Taxslayer Pro

Tax Accountant Resume Samples Qwikresume

Solutions For Tax And Accounting Experts Wolters Kluwer

Accountants Professional Tax And Accounting Solutions Intuit